Capital Accumulation Platforms

When & why did 5 person Venture Capital "partnerships" become 500+ employee "platforms"? Precisely when 'Adventure Capital' became spreadsheet investing.

The ‘prototypical’ Venture Capital firm in the 1980s had 5 equal partners — mostly men in their 40s & 50s — Ivy League graduates who were grizzled veterans of the High Tech world sprinkled with some investment banking & consulting stints (along with some old money heritage).

They went to the same ski resorts in the Alps each Winter, they hired professional CEOs to replace ‘prodigy’ founders, owned 33% of the company at entry, did a handful of investments each year and they made ungodly sums of money via IPOs.

45 years later, VC (which was considered a ‘boutique’ asset class) has become ‘industrialized’:

There is a SaaS funding napkin which dictates whether the spreadsheet investor will give you $7M or $10M in Series A funding

There are a dozen cohort based courses on “How to break into VC?” because there are 3 million courses on “How to break into IB?”

There are 3,500+ VC funds in the USA alone registered with the IVCA.

Dear reader, as the battle on the Indian border escalates, I would like to highlight that as a proud Indian passport holder, I stand by our Armed Forced and the Government - in solidarity here and would request everyone to adhere to the guidelines prescribed by the Ministry of Defense regarding refraining from commentary on the live situation

Jai Hind 🇮🇳

Humble origins

The OG Venture Capital investor Arthur Rock raised a $5M Fund in 1961 — he returned over $100M to his LPs in less than 10 years. His portfolio companies included Apple, Intel & a few others.

To put Arthur Rock’s achievement in context: This is equivalent to returning $900M+ on a $50M fund today.

Sequoia Capital’s founding partner Don Valentine raised a $3M Fund I in 1974 — he exited Apple Computers in 1980 just before the IPO generating $6M in proceeds from his $150K investment in the company.

So how did we go from these cute $30M to $50M (in today’s $ terms) fund sizes to GC’s $8bn Fund XII, Thrive Capital’s $5bn Fund IX?

Honest to God, most of these firms have been around for longer than I was alive so I asked Avnish Bajaj, Founder & GP of Z47** (a 18-year old VC fund in India with $1bn AUM). Avi sold Baazee to eBay for $50M in 2004 (an era where dial-up connection was considered cool).

Avi’s succinct answer was: “Managers of today’s mega funds have earned the right & built the trust with LPs to raise mega funds via their performance over the years. One has to choose whether one wants to be a MOIC or AUM investor. Both cater to different LPs.”

Like always, he double clicked into this statement:

“Software is eating the world” — something changed.

Marc Andreessen wrote a bold blog post on 20th August 2011 proclaiming ‘software will eat the world’ — 10 years prior & 10 years post, a bunch of factors came together to ensure that this proclamation became reality:

NASDAQ become VC Tech dominated🤯

‘Tech’ was 30% of S&P 500 right before the ‘dot com’ bubble burst.

In 2021, that figure was 42%. Software had officially eaten the world.

MSFT, Apple, Amazon, Meta, Netflix, Alphabet… the list of VC backed names in the S&P 500 is awe inspiring.

VC backed companies accounted for 41% of total U.S. market cap

Some VCs sold too early (to meet LP liquidity requirements) ⌛

Kleiner Perkins invested $12.5M in Google in 1999 — sold the position around the IPO netting $400M in 2004. Google MCap grew x20 from $23bn to $400bn in the next 10 years. KP caught the first x20, missed the next x20.

Benchmark Capital invested $6.7M into eBay in 1997 for 22% ownership — sold the position in early 2000s at the $20bn MCap mark. In 2004, eBay was worth $70bn. Missed the magical x3.

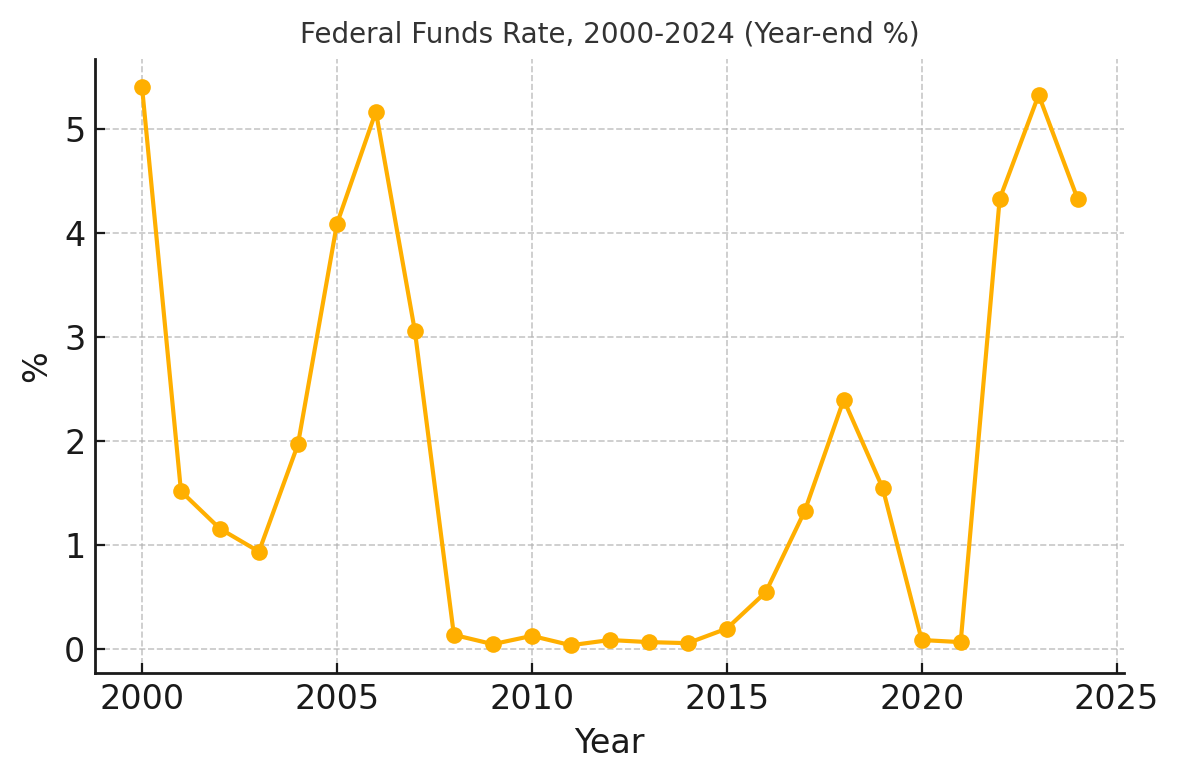

Change in cost of capital during the 2010s 💰

The Federal Funds Rate dropped from 5% pre-08 to the < 1% range for 10+ years

This low interest rate environment created a ‘risk-on’ mindset amongst capital allocators — they still had to meet their own cashflow needs (e.g. University Endowment paying for student scholarships & staff salaries)

To meet these outflows, capital allocators had to go towards riskier assets e.g. Venture Capital & Private Equity to generate some ‘alpha’

Hence, earlier hesitant LPs were willing to cut much larger cheques to VC funds.

Change in the LP base — Pension Funds, Sovereigns and Endowments🏦

By 2010, most capital allocators had read David Swensen’s manual ‘Pioneering Portfolio Management’ for how he ran the Yale Endowment

Capital allocators began buying into the idea of ‘alternatives’

The average American public pension’s alternatives allocation was 15% of assets by 2023

Whereas, state pension plans had 40% of assets in alternatives

Sovereigns wealth funds (e.g. Mubadala, QIA, GIC etc) entered the scene — their long term duration, permanent capital base & low cost of funds made them the LP of choice for fund managers looking to scale AUM.

Success of PE driven by leverage & crossover era

A number of PE & alternatives mega-funds who tasted success began to do cross-over investments i.e. $100M+ rounds in private companies prepping to go public.

Things went ape with Uber, AirBnB etc. Seed fund managers saw their control over crown jewels slip…

The cross-over investors provided secondary sale liquidity & also pushed companies to remain private for longer (time to IPO went from 4 to 7 to 13 years!)

For any successful VC fund manager from the 2000s era, the answer was clear they were leaving money on the table. To capture a growing pie of an even faster growing Tech Market Cap, they had to go:

🏢‘multi-stage’ i.e. do Pre-Seed to Pre-IPO

If you caught the winner early, why let someone else ride it?

🌲‘evergreen’ i.e. ability to hold stock in public markets too

why sell at IPO if you have asymmetric info about the business & the compounding has only just begun?

🏋️‘big’ i.e. have a large enough AUM to take advantage of special situations

why not staff a Govt relations team to assist your Defense focused portfolio companies?

or, why not become a media company?

The clickbait answer is:

Seed is for Suckers

“Why struggle to pretend you can do 8x over 20 years on a Seed fund when you can just write one big cheque into a winner and call it a day?

….. when outcomes are at ~$1bn, Seed is is great.

But, when outcomes are > $20bn to $100bn, Seed is for suckers…

if you have access to large capital pools which are forgiving (what today’s mega funds have) then you should absolutely play the big balls game”

Jason Lemkin is the GOAT of SaaS investing and these were his precise words on the 20VC podcast (linked below)

Jason and Rory O'Driscoll (Scale VC) double clicked on this issue exactly a week later:

“It just illogical liquid money (public markets) has a higher cost of capital than illiquid money (private markets).

Jason and Rory are both through-cycle investors — their sense is that the low cost of capital environment & LP patience is at an end. But, for now — the multi-strategy party is on in full swing.

Multi-strategy (with some examples)

The modern “mega-fund VC” is no longer a VC firm — it is a multi-strategy platform where VC is one of the many asset classes (or, investment teams):

General Catalyst

Why does a Venture Capital firm need to raise $6bn? - my flat mate asked me in Oct ‘24 when he read that General Catalyst raised a $6bn Fund XII

GC re-defined what 'Venture Capital' means. They are a Tech first multi-stage & multi-strategy investment firm.

Their investment strategies are:

“Hatch” as part of ‘Create’🐣

GC incubates a companies which operate in complex regulatory environments which requires high CAPEX & experienced founders w/ deep domain expertise biz.

They incubated Livongo Health in 2014, which is a $14bn public co today

They recently incubated Crescendo AI — an AI native call center with the former of founder Alorica (a $2bn revenue in call center); GC also led $50M Series C into the company at $500M round

“Transform” as part of ‘Create’🐦

This is GC’s “Venture Buyout” concept

Most of us have heard of the PE buyout concept i.e. the PE firm acquires a co, reduces headcount & adds process to create efficiency.

The Venture Buyout concept from GC is to acquire a company and infuse Tech to create efficiency.

Example: On 17th Jan ‘24 — GC announced its intent to acquire Summa Health in Ohio, USA (8.5K employees, 15 health centers and 2 hospitals). They aim to create a Tech-first healthcare experience.

Seed 🌱— across USA, Europe (via La Famiglia acquisition) and India (via Venture Highway acquisition)

Growth Equity📈

“Customer Value Strategy” i.e. Structured Finance💰

Example: June ‘23 — Lemonade Insurance from USA got a $150M line from GC to finance its CAC. Lemonade got a further $140M in CAC financing. GC financed 80% of CAC and would get a 16% IRR on the loan amount up to the cap.

Note: This section is extremely ‘dense’ but if you’re still looking for deeper info then please check the following links:

How GC’s Customer Value strategy works? (with an example)

a16z

a16z announced in April 2024 that it had raised ~$7bn in additional capital. In 15 years since inception, a16z has scaled to ~$42 billion in AUM with 500 professionals. 🤯

Their current structure is moving more towards thematic focused funds ⤵️

(a) Growth 📈(started in 2014) - $15bn across 4 funds

(b) BioTech 🧬(2015) - $2.9bn across 4 funds

(c) Crypto & Web3 🪙(2018) - $7.5bn across 4 funds

(d) Gaming & Media 🎮(2022) - $1.3bn across 2 funds

(e) American Dynamism🪖(2023) - $1.1bn across 2 funds

(f) AI 🤖(2024) - $1bn (Infra fund) & $1bn (Apps fund)

Every a16z sub-fund is spearheaded by a GP with a strong personal brand & deep domain experience (Chris Dixon for Web3, Andrew Chen for Gaming & Dr Vijay Pande for BioTech)

The analogy I've heard is: Blackstone went public in 2007. a16z has done to Venture Capital what Blackstone did to Real Estate. And, I wouldn’t be surprised if a16z’s management company goes public at some point — more on this at the end.

The math’s behind AUM gathering

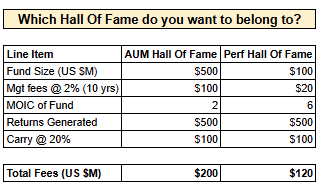

This single table succinctly explains why being an AUM gatherer is pareto superior financial outcome for the GP of a VC fund (calculations here)

Put simply — IF you are a performing manager across 2-3 cycles THEN you have every incentive to scale your AUM:

In our example, even IF your returns are x2 (versus x6 at the smaller AUM), you walk home with $80M extra in fees & carry

Doing a x2 is MUCH easier than a x6 — maybe you can squeeze in a few more holidays? Or, use that extra management fees to staff out a wider team to reduce your workload?

The part which pisses LPs (investors in these funds) off is that Mgt fees are fixed & front-loaded versus Carry which is variable & back-dated. As a result, IF Mgt fees are larger than Carry then the alignment of interest completely breaks!

e.g. in our above example, the Mgt fees of $100M = the Carry earned of $100M

Therefore, in the above cashflow schedule — by year 5, the GPs in ‘AUM Hall Of Fame’ have billed $100M in fees (!!) — it would take the GPs in ‘Perf Hall Of Fame’ a full 5 years to cross $100M in fees.

Now, reality is of course more complex — management fees are typically ploughed back into staff salaries, rent, legal expenses etc. But, after a certain point, these costs don’t scale proportionally and the ‘delta’ fees flow right into the pockets of the GPs.

The temptation is unreal! Who wouldn’t want $100M in guaranteed management fee income?!?!

What is the future? Hint: Barbell — Boutique or Ballistic

The succinct answer to “what is the future of Venture Capital?” comes from Bucky Moore, Partner Lightspeed (full podcast linked below)

"I see a world in which both ends of the barbell really really continue to rise, meaning small dedicated specialist firms on one end and large platforms on the other end. And I think that uncanny valley in between is going to be an increasingly challenging place to be over time if this notion of trillion-dollar companies continues to play out the way it seems to be today." — Bucky Moore, on the 20VC podcast

Btw, what Bucky said is almost like a Law of Nature e.g. when the Internet came about — it let a thousand niches flourish (blogs on esoteric topics) but it also destroy the local average newspaper (generalist without opinion or depth).

While LSVP, GC, Sequoia and others build AUM platforms — there are some managers who remain boutique despite mind fuddling performance:

Benchmark has been consistently raising a $425M fund every 3 years since 2006

Cyberstarts has a $60M Seed Fund IV despite being the 1st investor in $50bn of MCap in less than 8 years 🤯 (I wrote about Gilli’s ‘Sunrise’ investment process here)

Union Square Ventures (USV) has been consistently below $250M in each fund since inception in 2004.

Note: Some of the boutiques do raise larger pools of capital from LPs via Opportunity Funds & SPVs to double down on their winners. The list of boutiques remains large even today — Floodgate, First Round Capital, Foundry Group etc.

The throughline between what Jason Lemkin and Bucky Moore said is IF you believe outcomes are MUCH larger today (e.g. $100s of billions or even trillions) AND you have the track record THEN doing a platform play is a no-brainer. - My reflections

Closer to home in India — do we have platforms? Early days

As I had covered on Twitter a few days back, India’s Venture Capital industry is going down the same route as USA → from boutique generalist firms (at inception) to a barbell between large AUM platforms and boutique vertical focused firms.

There are a few (relatively) large AUM platforms in India

PeakXV (f.k.a. Sequoia Capital India) — $9bn AUM

Z47 (f.k.a. Matrix Partners India)** — $3.5bn AUM

Elevation Capital (f.k.a. SAIF Partners) — $2.6bn in capital raised

Nexus Venture Partners — $2.6bn in capital raised

Few points to highlight about the Indian platforms:

Each firm has been around for 15+ years in India, only Nexus didn’t have a global brand affiliation.

By Indian standards, ≥ $1bn AUM for a VC firm puts it in the ‘platform’ category (which in the US wouldn’t qualify, would need to in the $10bn range to qualify)

NONE of these platforms do Wealth Mgt, PE & other esoteric structure finance products like their global platform peers.

BUT, some of them have expanded from their origins of early stage Venture to doing Growth (Series B+) and some traditional investments (e.g. NBFCs)

Lightspeed India & Accel India don’t count because of their ‘one global team’ structure wherein funds may be different or carved out — but their coupling is too tight to call them domestic funds. GC India is too early to comment on.

The best example of boutique vertical focused firms is in the Consumer Brands category in India:

2012: DSG Consumer Partners - early in Sula Vineyards (₹3000 cr MCap @ listing) and The Moms Co (acq. for ₹500 crore)

2014: Sharrp Ventures (Marico family office) - early in Nykaa (₹1L crore MCap @ listing)

2017: Fireside Ventures - early in Mamaearth (₹10K cr MCap @ listing)

2019: Sauce VC - early in Hocco Icecreams (on track to do ₹200 cr revenue in < 4 years of launch)

2019: Spring Marketing Capital - invested early in Mosaic Wellness* (last valued at $400M)

2022: V3 Ventures - early in GoZero (annualized ₹100 crore in Sales in < 2 years of launch)

“Venture Capital in the USA had a 60+ year head start on India and US nominal GDP is almost 7x the size of India — as VC in India matures and we transition to a developed economy (by 2047) — you can expect many more large AUM platforms emerge.” — My belief

What is the end goal of getting big?

In bodybuilding & men’s physique, the goal of getting big is to win the trophy on the show day. But, investing is a very different sport — you have the IPO (‘show day’) but you have the quarterly (‘performance day’).

Avi read everything above & said “yeah sure - all valid points, but you aren’t thinking outcome backwards — why get big?”

The answer lies in what Private Equity peers have done:

KKR — IPO in 2010

Apollo Global Management — IPO in 2011

Blackstone — IPO in 2017

The end goal for all mega-funds is to IPO their management company — hence we’ve seen all the major VC funds switch to the RIA license (a16z & GC in 2019, Thrive in 2021 and Lightspeed in 2024).

Public companies are rewarded for predictability of revenue & cashflows → management fees are predictable & fixed versus carry which is jagged and variable. Hence, the incentive is to grow AUM to generate more fees. The only way to grow AUM is to expand the platform by adding more investment strategies.

The statement “Venture Capital is now Private Equity” is in the vogue right now. Personally, the lines are being blurred - Venture Buyouts are the new PE Buyouts, PE shops buy SaaS businesses today — Software has truly eaten the world. Software is now an established industry — hence the capital pools catering to Software need to mature.

Discl: Views are my own. Material shared here is for informational purposes only & should not be treat as a recommendation or solicitation to purchase stocks or schemes mentioned. This is not directed at any existing or prospective investors in Z47, DeVC & affiliated investment schemes. I am employed by Z47 as part of the DeVC investment team**

Love this analysis Rahul, left me wanting more. Can't wait to write the next post.

Just stunned by the depth of this article. How do I learn to write like this? Could you share some research tips please?